So you think you can trade!

Trading is very tempting. It is enough to look at charts of historical data, translate stock price fluctuations into dollars and let our imagination take over. But it is so easy to believe in hindsight and to bet big money on it. However, trading is a very tough profession with more people losing money than making it. In fact, experience shows that 80% of amateur traders lose to the 20% of professional traders in their first year of trading!

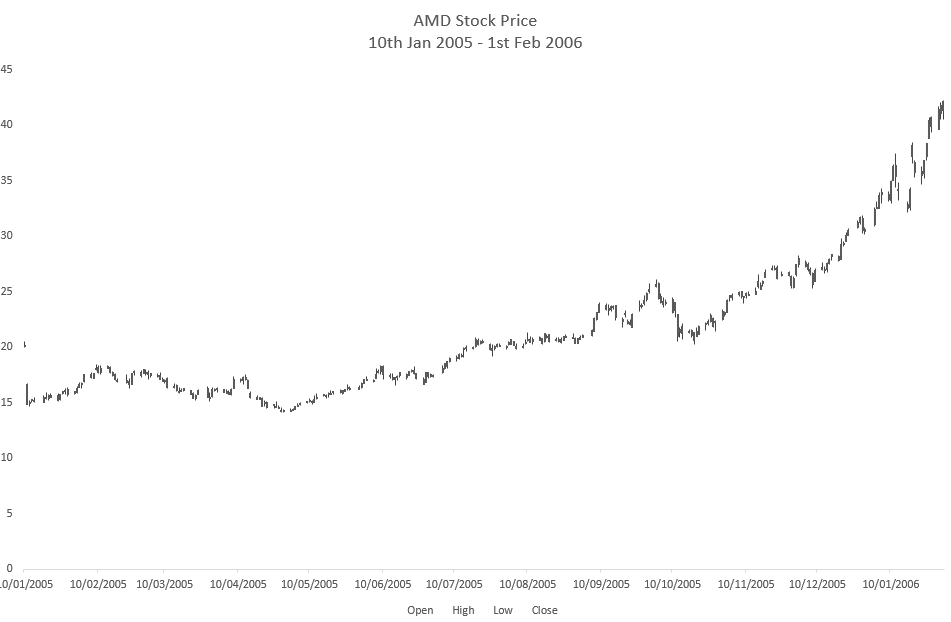

There's an old adage in the financial markets stating that the easiest way to make one million in the market is to start with TWO million! But how can this possibly be? The charts clearly show that, if you buy at the bottom and sell at the top, you'll make so much money. Easy, right? Not quite! Let’s take an example. Examine the chart on the left. It shows AMD stock price between the 10th of Jan 2005 and 1st of Feb 2006. The market has been in a nice bull run since 2002. AMD looks good on the chart. Would you have bought? (Come on, be honest... no one is going to know!).

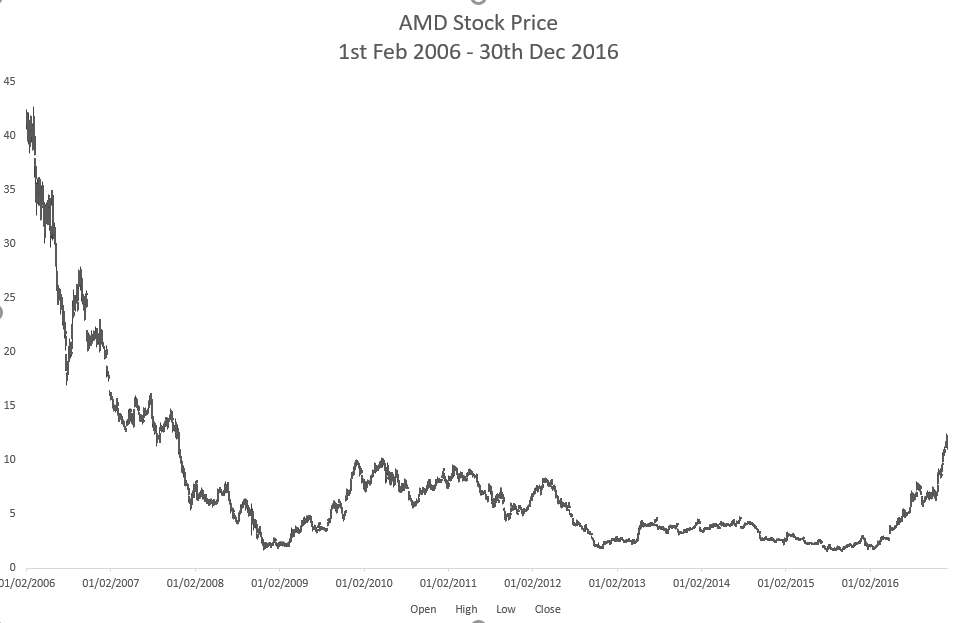

Suppose you have bought at $ 42 in 2006, stubbornly holding on to the stock, you would have lost around $40 for

each share that you have bought! Eventually (and luckily), the stock has recuperated its

losses but not before 2016. As the chart on the left shows, the price has surpassed $42 again towards the end of 2019 but

this means that you would have had to wait more than 10 years to get your money back!

How do I start trading?

This is not to say that it is not possible to make money in the market. Historically, the market has produced professional traders, ranging from those who make money to earn a good living to those who are billionaires. So what is the secret?

Three of the most important ingredients in making a successful trader are: self-discipline, education and a proven, well-tested trading system. You have to achieve the first on your own. No one can help you with that. But we can help with teaching you about some of the existing models in the market as well as allow you to implement and test them using our web-based platform for free or our fee-based spreadsheet, which you can download on your device. Proper education is the backbone of any successful career. You do not just wake up in the morning and you are suddenly a neuroscientist! It takes years of hard work to accomplish this and trading is no different. To do this properly, you need to treat your trading as a proper business, starting with a proper business plan.

Business Plan

Trading should be approached as a business. Before setting up a business, one starts with a business plan. This takes a lot of work, but it is worth the effort. Pretend that you are pitching your business plan to a potential investor so you will not only include your hopes and dreams of big money but also your methodology and your costs. You may like to take the following considerations into account.

- Your vision: Every business has a vision to guide it through. It gives you a sense of direction and a general outlook of what you really expect from your trading business.

- Your investment horizon: are you looking to trade in the shot-term or invest for the long-term? If the terminologies “short-term” and “long-term” confuse you, you can instead think in terms of day-trading (you close your positions before end of day), days, months or even years. Think of what may influence this decision: how regularly can you check your investments and/or follow the market? Do you hold a day job and you are just looking for an additional income? Are you wealthy and looking to invest part of your wealth? Are you intending to be a full-time trader? Are there any other circumstances that you should consider? Your personality also plays a role in this decision.

- Your objective: your initial investment and your target profit (in percentage terms or dollar amounts) for that period. You may also like to include which asset classes you would like to trade and any particular specialisation.

- Your budget and cashflow system: you include here any costs and expenses you will incur for your business. They can be fixed costs such as hardware and trading software costs as well as running costs such as brokerage fees, margin requirements, telephone bills, data purchase and office supplies.

- Your Back-Office system: you definitely need to include a trading backlog and a form of frequent monitoring (e.g., daily or weekly) of your trading P&L (Profit and Loss).

- Your trading system: this is the backbone of your trading business. Without it, you do not have a business and you may be out of the market sooner than you expect. Under this section, you will specify clear definitive trading rules, your system’s testing results, and your money management rules. You may also choose to include different trading systems for different types of markets or a contingency plan for adverse market conditions.

Money Management Rules

After you have developed and tested your trading system, you need to put few money management rules in place. At the very least, and provided that you stick to them, they can help to prevent you from losing all of your money in the market. In general, they help improve profit expectations. There are many money management rules in the market, some more sophisticated than others. The rules you opt for have to be well studied and to suit your behaviour and trading style. Common money management rules include, but are not limited to:

- Stop-loss on a single trade not exceeding 7%.

- Not risking more than 5% of your total account size on a single trade.

- Constant monitoring of a position as a percentage of the account size.

Brokerage Account

In order to be able to trade, you need someone to clear your trades. This is usually done via a broker. A broker allows you to open a brokerage account which you fund at set-up and use these funds to buy and sell investments through the broker. Take your time in selecting brokers: do your research, call them up or write to them with questions, read through their literature and compare them to other firms. Once you have decided on the broker, setting up an account becomes a straightforward process. You simply need to complete an application, usually online, and transfer funds into your new account. Some brokers may ask for further documents. But, in principle, you can start trading as soon as your account is funded. For tax considerations, it is better to check with your tax attorney or advisor. There are different types of brokers but what you need to consider is the same for all. First, let us discuss the various types of brokers.

Types of Brokers

Full-service Brokers

Full-service brokers, like discount brokers, execute trades for clients but they also provide various facilities that discount brokers do not. For example, they may do research on various investments and provide advice. They may even offer relationship management and offline services such as walk-in or physical branches. However, they charge much higher fees. Examples of full-service brokers include UBS, Wells Fargo Advisors and Merrill (previously Merrill Lynch).

Discount Brokers

Discount brokers execute trades but they do not do any research or give any advice, which is why they are able to charge much less fees or commissions than full-service brokers. Most discount brokers offer their services online those days. Many of them even provide you with sophisticated tools and software to perform your analysis. In recent years, some discount brokers removed commission fees for trading certain financial assets. Examples of discount brokers include Charles Schwab Corp., TD Ameritrade and E-Trade Financial Corp.

Robo-advisors

Robo-advisors can possibly be placed between full-service brokers and discount brokers. They provide investment management solutions, including advice and execution, provided by an algorithm rather than a human investment manager. This is the reason why they are also able to charge lower fees than full-service brokers do.

Trading Apps

Another disruptive technology has been offered by trading apps, some of which have slashed trading commissions to zero. However, it is important to dig deeper into any “fees in disguise” that may be there. Examples of trading apps include Robinhood and FreeTrade.

Social Trading Platforms

These platforms are essentially social networks for traders.

They allow traders to see what other traders are doing and even to copy more

experienced traders. Some of these platforms also allow trade executions and give the user access to a wide range of financial assets including cryptos.

Examples of such platforms include eToro and ZuluTrade.

What to consider when opening a brokerage account

Commissions

These are transaction costs that you incur whenever you

place a trade. Brokers charge commissions for every investment they buy or sell

on your behalf. This is how they mostly make their money. Some brokers charge

less commission than others. You may not see it now but commissions can

eventually add up to a sizable amount. However, the last thing you want is to

save on commissions but end up with bad fills, which can occur if you end up

buying at a higher price or selling at a lower price than you are supposed to.

Slippage Costs

Slippage costs are incurred when a trade gets fulfilled at a

higher price than the expected one. You do not really have much control over

these costs. It is also difficult to put a number on them beforehand since they

greatly depend on market volatility at the time (especially when placing a

market order-we will explain this later) or when you trade in large lots and

there is not enough supply or demand (volume) in the market to meet your needs.

Having said so, it does not harm to keep these costs in mind before you start

trading.

Fees

Minimum Deposit

Margin Requirements

Usually, there are two types of accounts available with a broker: a cash account, whereby you pay for your securities in cash, and a margin account, which allows you to borrow money typically up to a particular percentage of the purchase price against marginable securities in your account. So, in the latter case, you are able to buy more assets than you would using cash only (alarm bells?!). For example, suppose a stock is worth $100 and you have $10,000 in cash: you can either buy 100 shares with these $10,000 or use the 50% margin to buy 200 shares instead. Of course, this does not come at a cheap cost and in steps the margin requirement, which differs between brokers.

In practice, a margin requirement can be further divided into an initial margin requirement and a maintenance margin requirement. An initial margin requirement is the minimum amount of money (as a percentage of the purchase price) that you should pay to be able to borrow on margin. This is set by Fed regulators at 50%; however, exchanges can opt for a higher amount.

On top of this, your broker will charge you for maintenance margin to cover themselves against market volatility and price fluctuations. It can be set at a lower value than that of the initial margin requirement. However, as soon as you are no longer able to maintain your equity above this value, you will receive what is known as a “margin call.”

It may be difficult for a beginning trader to grasp the concept of margin. If the market moves in your favour, you can end up making much more money than had you bought only in cash. However, if the market moves against you, that is the asset moves in the opposite direction to what you would have expected, you can end up losing a lot of money. Think of it as financing a new house with a loan: if house prices go up, you will be in a very favourable position but, if house prices go down, you can be in deep trouble because you still need to pay your bank the full amount of the loan albeit on a house with lower equity!

Therefore, it is a double-edged sword. If you decide to get into it, make sure you understand the risks involved really well. Think of the best case scenario, the worst case scenario and how much your broker would be charging. Only then will you be able to make a sound decision.

Order Types

- Market order: this is the simplest type of order. It simply means that the trade gets executed at the next available price, which means immediate execution but you are subject to market volatility and you do not have any control over the price. So, for example, if you are buying a stock, you may end up paying a much higher price than you desire.

- Limit order: under this order type, you get to specify the price at which you would like the trade to execute. Thus, this type of order gives you a bit more control over the execution price. However, the price is not guaranteed, and you may actually miss on a trade because of that.

- Stop-loss order: this type of order can be

thought of as protecting your assets against major losses. You place a

stop-loss order with the broker to buy or sell your asset if the asset price

reaches a certain level, for example 7% or 10% below the purchase price. So you

would still end up with a loss but, at least, your loss would be limited

against major market swings. On the downside and once your stop-loss order is

activated (that is, the market price hits your desired price), you do not have

control over the execution price because the market can be moving swiftly and

violently as to go through this price into a less favourable one. For example, suppose you own a $100 stock and so

you set a stop-loss order to sell at $93. The market gets into a freefall and

the stock price crosses $93 without your broker being able to fulfil it at your

price. Eventually, you may end up getting an $85 per share in proceeds so you

have lost $15 (15% of the purchase price) instead of $7 (7% of the purchase

price)!

- Stop-limit order: this type of order allows you

more control over the execution price because it is a limit order. However, you

may end up missing on the trade altogether if the market moves against you really fast. So to go back to our above example, if the stock

price moves very quickly through $93 or jumps downwards beyond $93, your broker

will not be able to execute the trade and you may well find yourself losing 40%

or 50% on your purchase.

How to open a brokerage account

Once you have done your research and selected a broker who meets your needs, call the broker up and request application forms or download the forms online. Fill up your forms carefully, keep a copy and send the original documents back alongside your deposit. The process after that depends pretty much on the broker: some brokers may open your account before they even receive the final forms. Anyway, the whole process should not take more than few days. Once everything is in order and sorted, you can start trading. If your broker does not impose a minimum deposit amount, start with the smallest capital you can afford to lose. It is even not a bad idea to start paper trading first, where you set-up virtual portfolios allowing you to trade virtually. This can help you understand to a certain extent the intricacies of the market without committing any money. Whatever you decide upon doing is totally up to you but always keep in mind that it is easier to lose, rather than make, money in the markets. Also, do not let beginners’ luck deceive you! Make sure you follow your rules no matter what!

Education

Educating yourself well is the first step that you have to take before trying to embark on a successful trading career. Before you build a proven system, you need to understand the underlying model and to make sure that it fits with your personality.

There are plenty of successful traders using different

models; the one thing they have in common is that they have studied their

models well, tested them exhaustively and made sure they stick to them. Two of

the most common approaches in the market are fundamental analysis and technical

analysis, which this website will cover. There are other models based on

behavioural finance and other innovative research, but they are beyond the

scope of this website. As a trader, not only do you need to start with a

solid foundation and understanding of your trading model but you also need to ensure that you are continuously keeping in touch with market

news. Most brokers provide market summaries for different times of the day.

They may also provide extensive research on a particular stock, which you may

find beneficial. You should always keep up to date with real-time news covered in financial newspapers and dedicated

television news channels.

Market Data

Once you have developed your trading system, you need to test it as extensively as possible. This cannot be done without accurate market data. First things first: what is market data?

In simple terms, market data is trading-related data specific to an asset and a time frame, for example, intra-day, end-of-day, weekly, monthly, etc… Data may depend on the type of the traded asset. However, it generally includes date (and sometimes time), price (for example, high, low, open, close) and volume. Where necessary, prices are normally quoted in decimals rather than fractions to facilitate trading and understanding of prices. Second, what type of market data do I need? The frequency of market data that you need largely depends on the type of trading you opt for. For example, if you are a day trader, then you need access to intra-day data (prices during the day). For a longer trading horizon, you may find closing or end-of-day data more than enough for your purposes. Be careful where you source your data from. If it is free, it may not be as accurate and as reliable as you think it is. These days, plenty of brokers can provide you with data free of charge if you open an account with them.

Taxes

Needless to say, you need to sort out your own taxes. It is better to discuss with your tax advisor or tax attorney before setting up an account.